IMPORTANT NOTE

- The ETF aims to provide investment results that, before fees and expenses, closely correspond to the performance of the S&P High Yield Asia Pacific-Ex New Zealand REITs Select Index (Net Total Return) (“Index”).

- Investment involves risk, including the loss of principal. Investors should refer to the prospectus of Samsung S&P High Dividend APAC ex NZ REITs ETF (the “ETF”) for details, including the risk factors. Investors should not base investment decisions on this material alone. Historical performance does not indicate future performance.

- The ETF could be subject to certain key risks such as risks of Asia Pacific market real estate sector concentration risks; Risk associated with investments in REITs; Real estate sector risk; Asia Pacific market risks; New index risks; Other currency distribution risks; Multi-counter risks, etc. Please note that the above listed investment risks are not exhaustive.

- The Manager may at its discretion pay distributions out of capital, or effectively out of capital, of the ETF, amounting to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment, resulting in an immediate reduction of the NAV per unit

Product Video

Income opportunities in a low interest rate environment during inflation

- Protection against inflation remains one of the major investment themes of 2023

- High dividend yield REIT remains an attractive fixed income asset class as there is still significant spread between high dividend REITs and treasury yield.

- Underlying index is comprised of 30 REITs listed in developed markets across Asia Pacific (excluding New Zealand) with the highest trailing 12-month dividend yield. Latest index indicated yield was 5.58%* as of 31 May 2023.

- 3187.HK aims to pay out dividend quarterly, subject to Manager's discretion.

- Most of the Asia REITs are required to pay out at least 90% of their net earnings as dividend. Thus, the income streams that REITs generate are relatively stable.

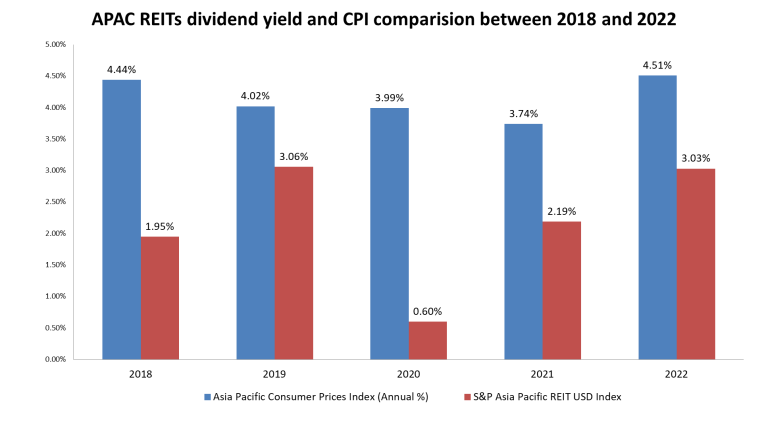

REITs as inflation hedge

- REITs are natural hedge against inflation as value of real estate is expected to increase when inflation rises

- Real estate rents and values tend to increase during inflation

- APAC REITs have higher dividend rate than the consumer price index in recent years

Source: Bloomberg, as of 30 Dec 2022

Source: Bloomberg, as of 30 Dec 2022

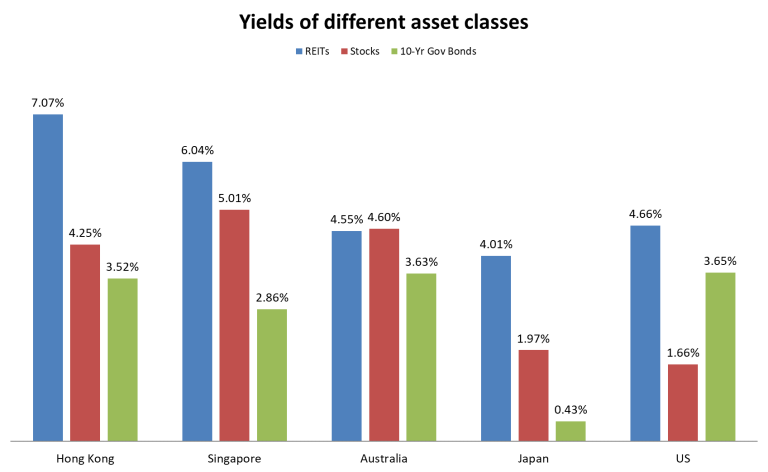

Why investing into Asia REITs ?

- Captures Asia economic recovery opportunities

- Asia REITs have a lower correlation with other assets. Include Asia REITs in your portfolio can achieve effective diversification

- REITs generally have higher dividend rates than stocks and long-term bonds, providing investors with considerable passive income

Source:Bloomberg, investing.com, as of 31 May 2023.REITs yield: HK REITs - Hang Seng REIT Index, Singapore REITs - iEdge S-REIT Leaders Index SGD, Australia REITs - S&P/ASX 200 A-REIT Index, Japan REITs - Tokyo Stock Exchange REIT Index, US REITs - MSCI US REIT Index. Stocks yield: HK stocks - Hang Seng Index, Singapore stocks - Straits Times Index (STI), Australia stocks - S&P/ASX 200 Index, Japan stocks - Nikkei 225 Index, US stocks - S&P 500 Index

Source:Bloomberg, investing.com, as of 31 May 2023.REITs yield: HK REITs - Hang Seng REIT Index, Singapore REITs - iEdge S-REIT Leaders Index SGD, Australia REITs - S&P/ASX 200 A-REIT Index, Japan REITs - Tokyo Stock Exchange REIT Index, US REITs - MSCI US REIT Index. Stocks yield: HK stocks - Hang Seng Index, Singapore stocks - Straits Times Index (STI), Australia stocks - S&P/ASX 200 Index, Japan stocks - Nikkei 225 Index, US stocks - S&P 500 Index

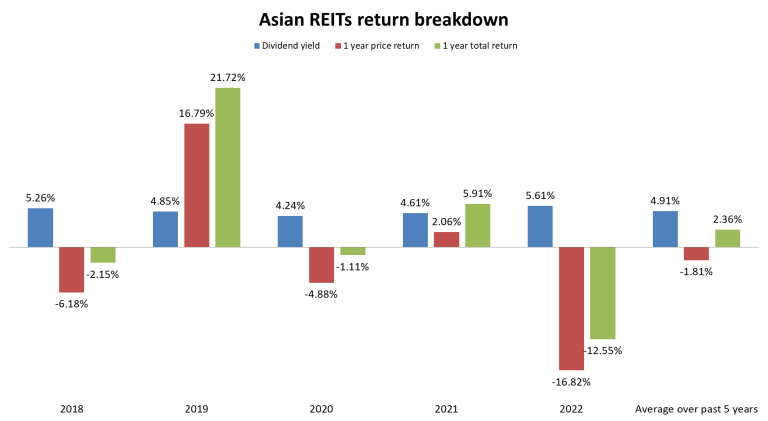

- Dividend income is part of the major returns for Asian REITs

Source:Bloomberg, S&P, as of 30 December 2022.Asian REITs return is the performance of S&P High Yield Asia Pacific-Ex New Zealand REITs Select Index

Source:Bloomberg, S&P, as of 30 December 2022.Asian REITs return is the performance of S&P High Yield Asia Pacific-Ex New Zealand REITs Select Index

3187 / 9187 - The First REITs ETF in Hong Kong#

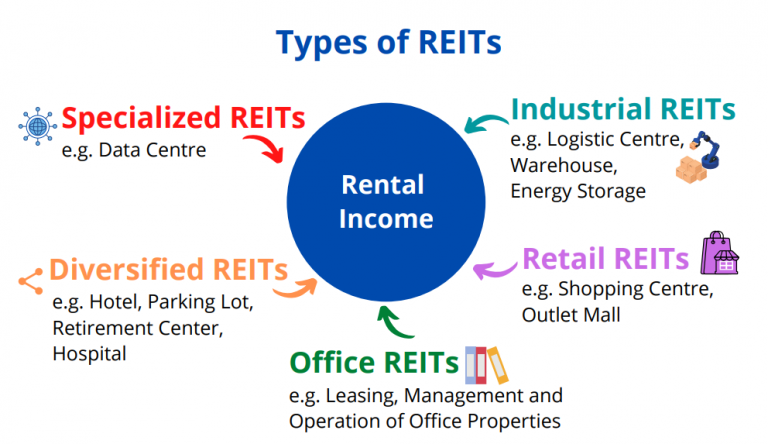

- One stop REITs solution - Currently investing into developed Asia REITs. Besides traditional REITs including residential, shopping center, office and hotel, the ETF is also investing into REITs with relatively low correlation to traditional economy such as data center, logistics center and retirement center.

- Easily invest in different Asia-Pacific markets - ETF invests in different markets in Asia-Pacific (excluding New Zealand), including but not limited to Hong Kong, Singapore, Australia, Japan, etc., to help investors capture interest-earning opportunities in the Asia-Pacific market.

- Relative Low Investment threshold – You can invest into a basket of Asia REITs with just around HKD3,500* as of 231 May 2023.

- Potential dividend opportunity - Quarterly (in March, June, September and December) subject to Manager's discretion.

10 holdings as of month ended 31 May 2023

| REIT Name | Listing Place | Weighting |

| LINK REIT | HONG KONG | 9.25% |

| HULIC REIT INC | JAPAN | 7.56% |

| NTT UD REIT INVESTMENT CORP | JAPAN | 6.80% |

| CAPITALAND INTERGRATED COMMER | SINGAPORE | 6.35% |

| KENEDIX RETAIL REIT CORP | JAPAN | 5.55% |

| NIPPON REIT INVESTMENT CORP | JAPAN | 5.54% |

| CAPITALAND ASCENDAS REIT | SINGAPORE | 5.54% |

| SCENTRE GROUP | AUSTRALIA | 5.46% |

| VICINITY CENTRES | AUSTRALIA | 4.32% |

| STOCKLAND | AUSTRALIA | 3.95% |

Distribution History

| Ex-Date | Record Date | Payable Date | Dividend Per Share (USD) |

| 23 Mar 2023 | 24 Mar 2023 | 31 Mar 2023 | 0.0415 |

| 20 Dec 2022 | 21 Dec 2022 | 30 Dec 2022 | 0.0120 |

| 22 Sep 2022 | 23 Sep 2022 | 30 Sep 2022 | 0.0412 |

| 22 Jun 2022 | 23 Jun 2022 | 30 Jun 2022 | 0.0210 |

- Distribution Policy: Quarterly (in March, June, September and December each year) (if any) subject to the Manager's discretion. Distributions on all Units (whether traded in HKD counter or USD counter) will be in USD only. Distributions may not be paid if the cost of the Sub-Fund's operations is higher than the yield from the Sub-Fund's cash and holdings of investment products. Distributions may be paid out of capital or effectively out of capital as well as income at the Manager's discretion. For the avoidance of doubt, please note that no distributions will be made in December 2020.

- a) Net Distribution Income” means (i) the net investment income (i.e. dividend income and interest income net of fees and expenses) attributable to the relevant unit class and may also include net realized gains (if any) based on unaudited management accounts. However, “net distributable income” cannot include net unrealized gains. (ii) which is not declared and paid as dividends in a period of a financial year can be carried forward as net distributable income for the next period(s) within the same financial year. “Net distributable income” that has been accrued as at the end of a financial year and is declared and paid as dividends at the next distribution date immediately after that financial year end could be treated as “net distributable income” in respect of that financial year. However, “net distributable income” which has been accrued as at the end of a financial year but is not declared and paid as dividends at the next distribution date immediately after that financial year end should be included as “capital” for the next financial year. (iii) where the fund may pay dividend out of gross income while charging / paying all or part of the fund's fees and expenses to / out of capital, the amount of fees and expenses that has been paid out of capital has to be deducted from the gross investment income in order to come up with the “net distributable income”.

- b) The composition of the latest dividends (i.e. relative amounts paid from (i) net distributable income and (ii) capital) for the last 12 months are available from the Manager on request and on http://www.samsungetfhk.com. The Manager may amend the above dividend policy with respect to payment of fees and/or dividends out of capital subject to the Securities and Futures Commission's prior approval and by giving not less than one month's prior notice to investors.

- The Manager may in its discretion make cash distributions to Unit holders out of capital or out of gross income (while charging/paying all or part of the Product's fees and expenses to/out of the capital of the Product) resulting in an increase in distributable income for the payment of distributions which is in effect a payment of distributions out of capital.

- Payment of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor's original investment or from any capital gains attributable to that original investment. Any distributions involving payment out of or effectively out of the Product's capital may result in an immediate reduction of the Net Asset Value per Unit.